SEL Column – Where to Find Opportunities

April 19, 2009

Check out our latest SEL column on how to find the right market and vertical for launching new services for SMBs, featuring a chart that shows the penetration of SMB advertisers on leading IYP sites in 8 verticals, covering 8 major cities: http://searchengineland.com/where-is-the-opportunity-17232.

Speaking at LeadsCon and Attending Kelsey’s Marketplaces 2009

February 12, 2009

I’ll be speaking about Local Search and Local Advertising at the LeadsCon conference, March 4-5, 2009.

I’ll be in Vegas for LeadsCon and then in LA, where I’ll be attending Kelsey’s Marketplaces 2009, March 16-18, 2009.

SEL Column – SMBs with Claimed Profiles

January 26, 2009

Our latest Search Engine Land column discusses how “SMBs Claim Their Online Business Profiles”. In this post we present a new target group of SMBs we call “Seekers”, SMBs who haven’t quite made the leap to online advertising, but are performing some kind of online activity.

Interested, informed, not quite sold but not adverse to buying, seekers are SMBs who may just prove to be great prospects for new online ad products. Armed with some knowledge of online advertising, they may just need a little help from the professionals to start engaging in more elaborate online marketing activities, and more importantly, to start spending money. Initial tests show they do indeed convert better than the average sales lead, and with up to 10% of SMBs falling in this category, there may be quite an opportunity here.

SMBs’ PPC Ad Spend on Search Engines

December 14, 2008

We’ve been collecting and analyzing ad spend data of SMBs on various local, vertical and IYP sites for over a year. Last month we started looking at SMBs who also advertise on search engines (i.e. businesses who bought PPC ads on search engines).

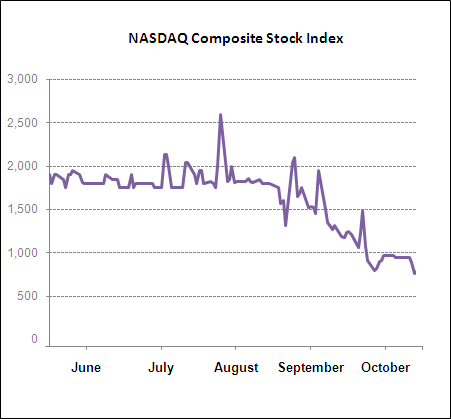

We looked at over 3000 SMBs who advertise online, on different websites, out of which we focused on 300 businesses who also advertised on search engines in the past 5 months. The chart shows the average monthly ad spend of SMBs on search engines over a period of 5 months.

The dramatic drop represented in the chart is probably larger than the actual drop in local search ad budget since we filtered out nationwide chains and all SMBs with more than one office location. The businesses represented in the chart are small businesses where the decision making process is swift, as opposed to large corporations, who have a longer decision making process. Additionally, changes in advertising patterns/behavior appear more quickly when it comes to PPC since PPC campaigns can be modified at any give time, unlike annual advertising contracts.

We cannot be sure of the cause for the significant decrease in dollars spent in the months of September and October. However, we did happen to come across another chart, the similarity of which to our own cannot be ignored…

Online Presence of SMBs and Monthly Ad Spend

September 18, 2008

A couple of months ago we published a chart that suggested that SMBs who claim or update their business listings on various online directories advertise more than those who do not. In a recent sales leads project for a customer we looked at businesses from various categories in the Denver metropolitan area and examined another feature of online presence of SMBs – whether or not the advertisers have websites.

We looked at over 2,800 Denver auto dealers and repair shops. Below is a chart that represents the breakdown of advertisers, with and without a website, to low, medium, and high-end spenders.

Contributing to SEL’s Small Is Beautiful Column

September 17, 2008

We’re very happy and honored to have been invited by Search Engine Land to take part and contribute to their weekly column on Small and Medium Businesses, Small Is Beautiful.

Our first column was published a couple of weeks ago, and we’ll have a new one coming out once a month. We hope you follow the column and let us know if there’s anything you’d like to see there. Our next post is scheduled to be published October 2nd.

Monthly SMB Online Ad Spend

August 7, 2008

Online Presence of SMBs – Target the Right Prospects

July 25, 2008

In a project we recently did for one of our customers, we looked at whether or not SMBs claim their business listing on various online directories. Owners of SMBs can claim their listings on online business directories relatively easily: they add information such as opening hours and special offers to their basic listings. The chart below shows the results of our analysis among Health & Beauty online advertisers and non-advertisers in the West Coast:

It’s no surprise that 45% of businesses who advertise online also claim their business listing on various online directories.

It’s interesting that as many as 18% of the non-advertisers we looked at invested the time in claiming their listing on various online business directories; they recognize the importance and value of online presence and visibility. This data suggests that there is an opportunity here among non-advertising SMBs – catch the ones who know the value of online visibility and convert them to advertising customers.

Targeting the right leads increases sales conversion rates. Palore can provide comprehensive analyses of SMBs’ online behavior and point to various opportunities that derive from these analyses. If you want to know more about our Sales Leads Service or if you’re interested in a custom project, contact us here.

Nationwide Report: Online Restaurant Reviews per State

June 27, 2008

At the request of our customers, we have been gathering nationwide rich data on restaurants. We now have a database of close to 1 million businesses in the food & dining vertical with rich details including but not limited to menus, special features, descriptions and user reviews. The data was gathered from over 70 local and vertical sites.Compiling a nationwide analysis of user reviews of restaurants, we took the total number of restaurants we found in each state and checked how many of them have at least one user review on at least one site.

The map below shows what percentage of restaurants, in each state, has one or more user reviews on at least one site.

The three states at the top of the list, where over 23% of restaurants have at least one user review, are Massachusetts, Washington and California.Palore can provide information on small businesses from hundreds of sites in any vertical and any market, including ad spending data. If you’re interested in a custom project contact us here.

Where are SMBs Advertising these Days?

June 15, 2008

Our previous post featured statistics on attorneys who advertise on Internet Yellow Pages sites. While working on several projects for customers in the food & dining and nightlife verticals, we gathered initial advertising data from 30 leading local, vertical and IYP (Internet Yellow Pages) sites.

We stumbled upon some interesting facts regarding SMBs online advertising patterns. We focused on whether Boston restaurants and NYC night clubs advertise on a single site* or on multiple sites.

The following two charts show the results:

* By “single site” we mean that the advertiser has elected only to advertise on one site – not that only one site is the preferred choice of all “single site” advertisers.

It wasn’t very surprising to see that most of the businesses in the verticals we looked at advertise on a single site, e.g. 74% percent of online advertisers among Boston restaurants. Also, it was interesting to see that the number of businesses that advertise on multiple sites is larger than we expected, e.g. as many as 13% of online advertisers among Boston restaurants advertise on 2 sites. An additional 13% advertise on 3 sites or more amounting to a little over a quarter of Boston online advertising restaurants that advertise on more than a single site.

There may be an opportunity here for local search sites to approach local business owners who advertise only on one site and interest them in larger, potentially more effective campaigns – Palore offers such sales lead services.

Another interesting point about the data we’ve extracted is that despite the differences between the target audiences of Boston restaurants and NYC clubs, the advertising patterns seem very similar.

As always, we’d love to hear what interests you. Contact us here to suggest analyses or order a custom project.